Overview of the Carbon

Markets

Article 6 of the Paris Agreement sets out how countries can achieve their climate and carbon emissions goals, by allowing international collaboration through the Paris Agreement Crediting Mechanism (PACM). PACM allows the international transfer of ITMO certified carbon credits that are earned through decarbonisation capabilities. This is a significant development, as it will empower emerging market countries with high carbon emissions to achieve “carbon zero” status with minimal impact to their productivity.

A carbon credit represents 1 metric ton of carbon released into the atmosphere and the UN allocates carbon credits to companies according to their carbon emissions. If those companies become efficient, they will have a surplus of carbon credits that can be sold to companies that have a deficit.

Another way to acquire carbon credits is to invest in decarbonisation projects that extract carbon from the atmosphere. As such, if a company releases 10 tons of carbon into the atmosphere, it will need to invest in decarbonisation capabilities that extracts 10 tons of carbon from the atmosphere to be carbon neutral.

Types of carbon reduction methods

New and innovative methods of decarbonisation are being discovered through ongoing research. Carbon Earth invests into projects that maximises the yield of carbon credits through decarbonisation initiatives.

1

|

Improved Forest Management

We provide funding for new decarbonisation initiatives that produce high yields of carbon offsets.

2

|

Renewable

We provide funding for new decarbonisation initiatives that produce high yields of carbon offsets.

3

|

Mineralization

We provide funding for new decarbonisation initiatives that produce high yields of carbon offsets.

4

|

Biomass with carbon removal and storage (BiCRS)

Our experts develop customized decarbonisation strategies that provide instant cash inflows for exiting decarbonisation capabilities.

5

|

Waste Management

We provide secondary market liquidity for carbon credits and CET, ensuring flexibility and accessibility for our clients.

6

|

Seaweed Sinking

We provide secondary market liquidity for carbon credits and CET, ensuring flexibility and accessibility for our clients.

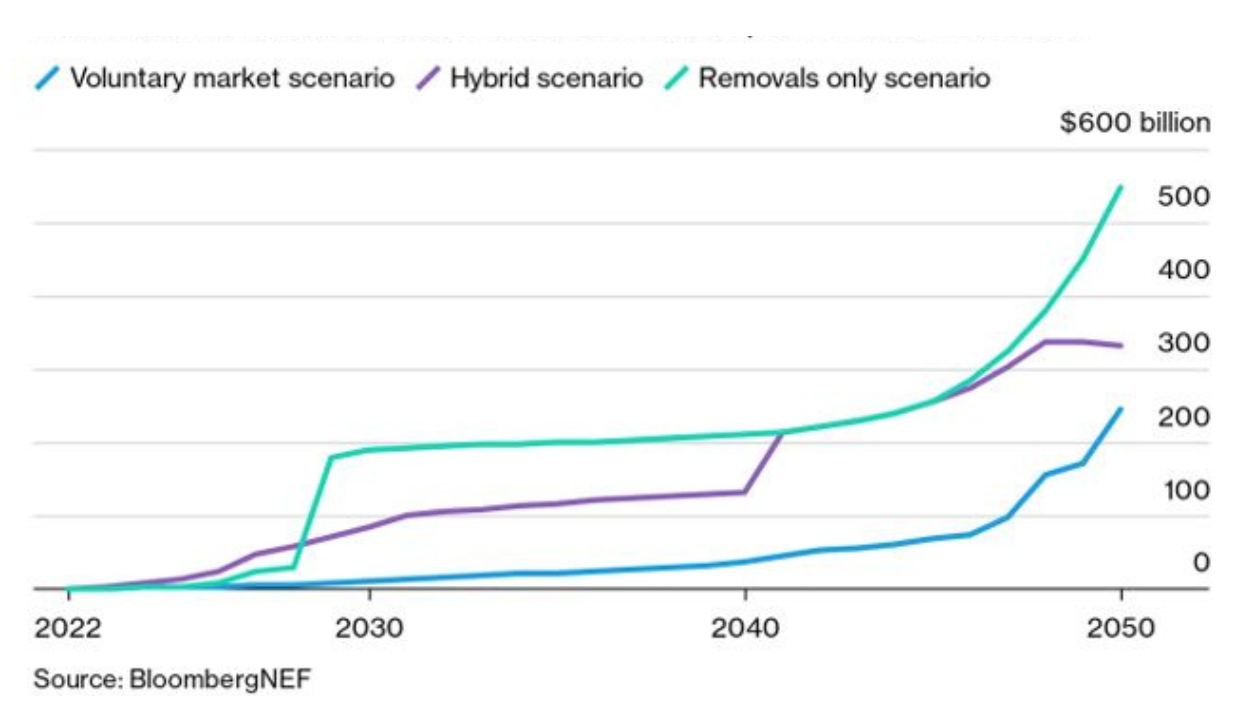

The UAE is one of 140 countries, including China and the US, that are committed to being carbon neutral by 2050, which can only be done by securing an inflow of carbon credits to offset their emissions. As such, the carbon market was worth $78bn in 2022 and expected to be worth $2tn by 2030, with the price of carbon credits expected to increase by 5000% in the foreseeable future. This demand for carbon credits will create a price support for CET while allowing for the upside potential of cryptocurrency.

All the funds that are collected from selling CET are used to invest in projects producing a high yield of carbon credits, that will be subject to 3rd party verification, certified by the ITMO, then tokenised and added to a staking pool where CET owners can stake to earn the tokenised carbon credits. Trees and other decarbonisation projects that we invest in do not stop decarbonising the atmosphere, so the yield of carbon credits is theoretically unlimited and perpetual.

The future of carbon markets

CET is perfect for investors who want exposure to Web3 solutions for the carbon markets, industries who want a safe-guard against carbon emissions restrictions and individuals who wish to be net carbon neutral or secure a high perpetual yield of carbon credits to sell internationally.